“Stock market corrections, although painful at the time, are actually a very healthy part of the whole mechanism, because there are always speculative excesses that develop, particularly during the long bull market.” ~ Ron Chernow

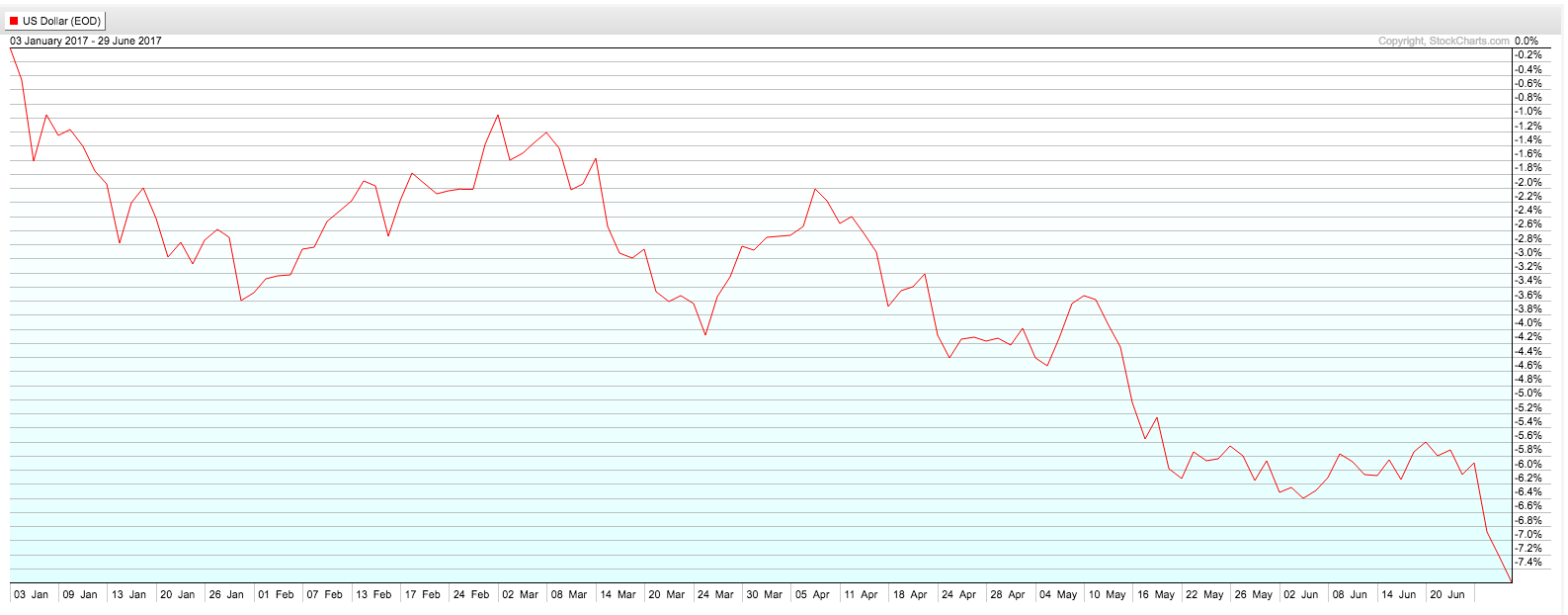

The US Dollar Index and oil price may been in the dog house, but equity bull markets just kept climbing that wall of worry during the 2nd Quarter 2017. European and emerging equity markets were strongest. Chinese markets were buoyed when MSCI finally gave the nod to the addition of 222 Chinese A shares to their emerging market index — to start next year.

The markets’ big question: “When in the heck are we going to get a major correction?” The majority of capital gains in the US stock market traditionally occur during November through June, hence the old expression: “Sell in May and go away.”

Are we in for a correction in the 3rd Quarter? That is my big question as I review the charts of the financial and commodities markets for the 2nd Quarter 2017.

US Dollar Index

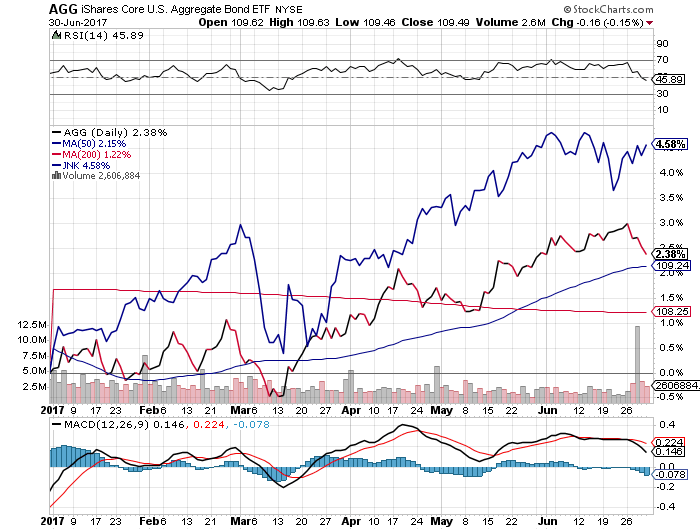

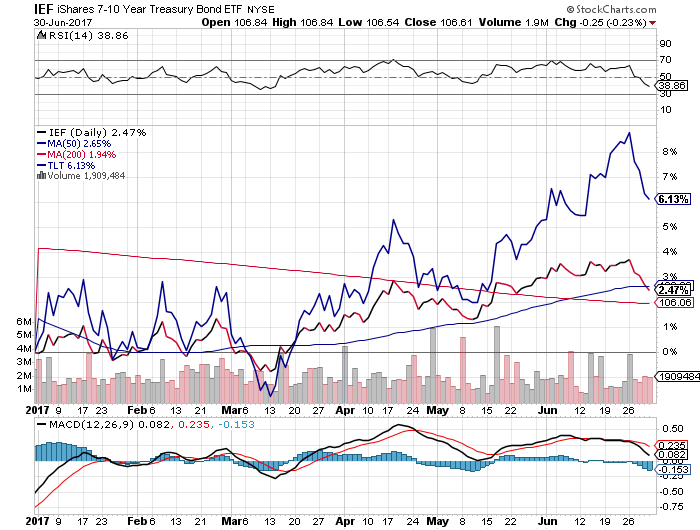

Fixed Income

US Bond Aggregate (AGG), High Yield Bond ETF (JNK)

5-7yr Treasury ETF (IEF), 20 yr. + Treasury ETF (TLT)

Equities

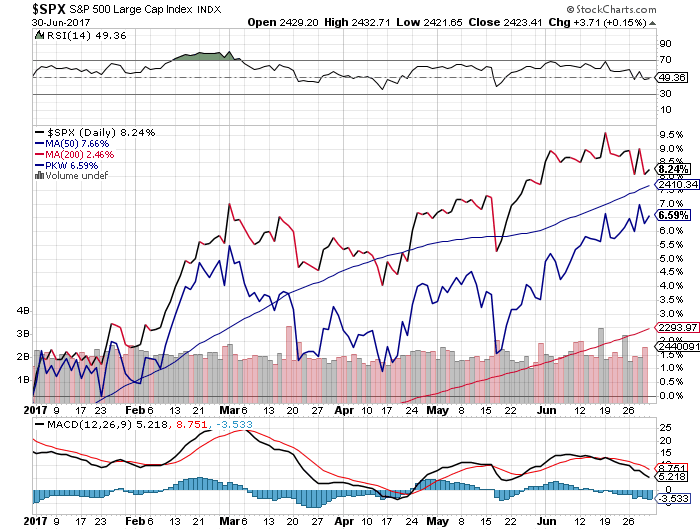

S&P Large Caps (SPX), Buybacks (PKW)

U.S. Small Caps (SCHA), U.S. Mid Caps (SCHM), U.S. Large Caps (SCHX)

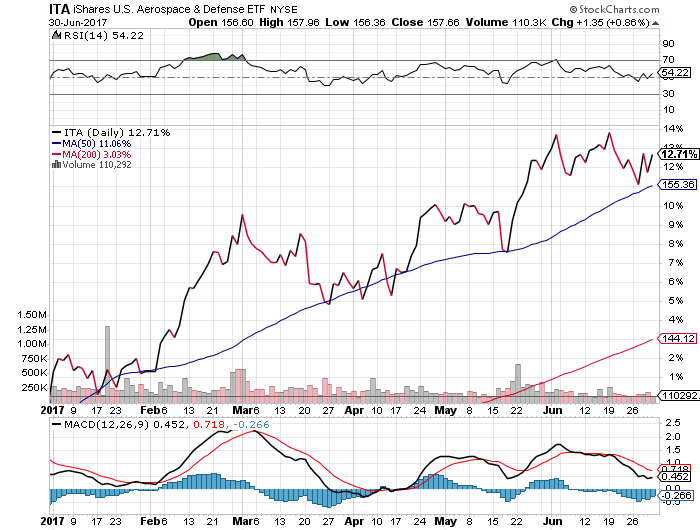

US Aerospace & Defense (ITA)

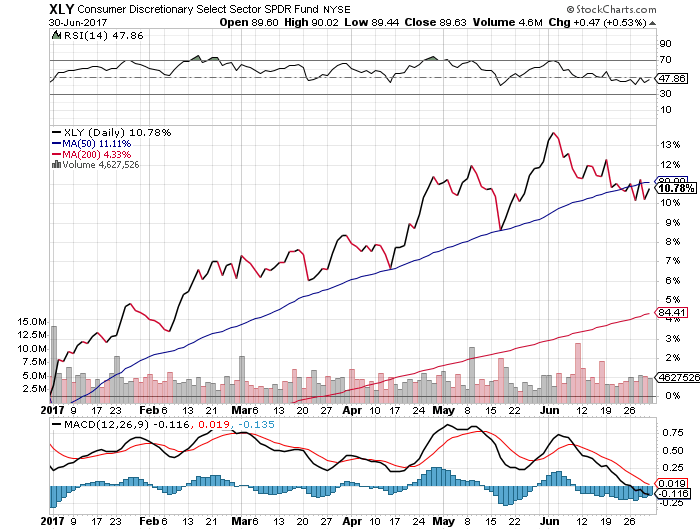

Consumer Discretionary (XLY)

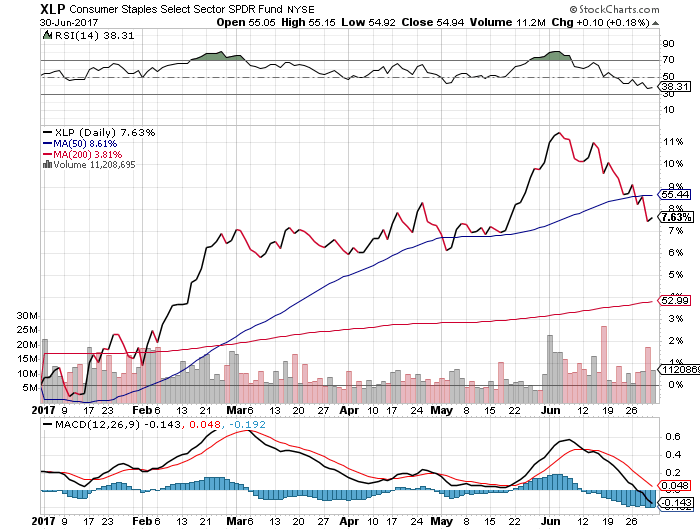

Consumer Staples (XLP)

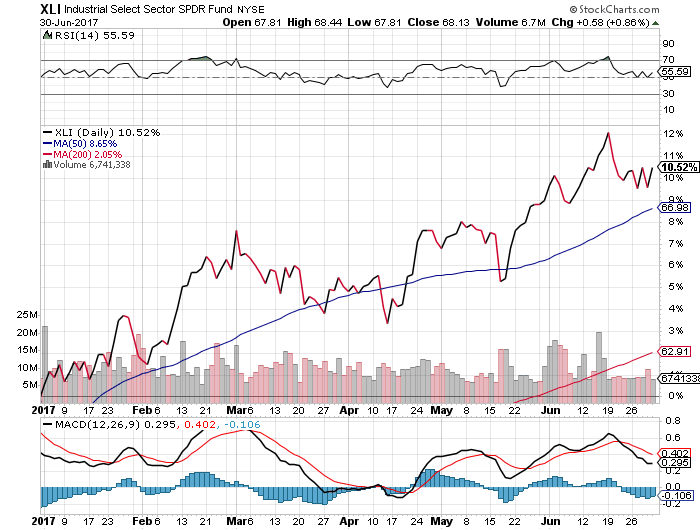

Industrial Select (XLI)

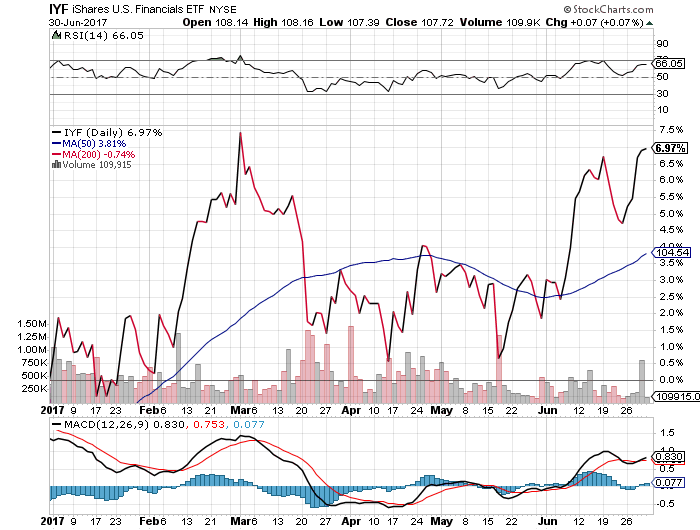

U.S. Financials ETF (IYF)

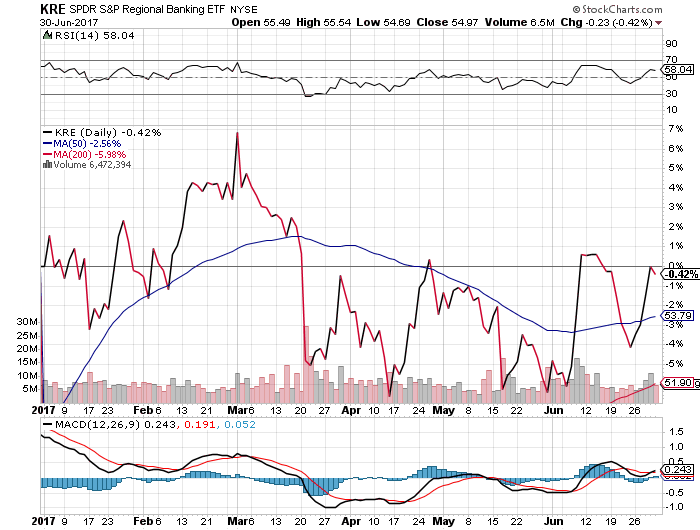

S&P Regional Banking (KRE)

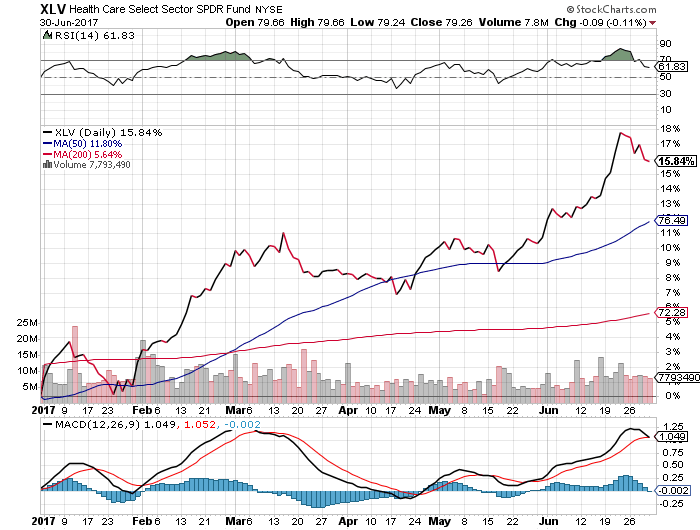

Health Care (XLV)

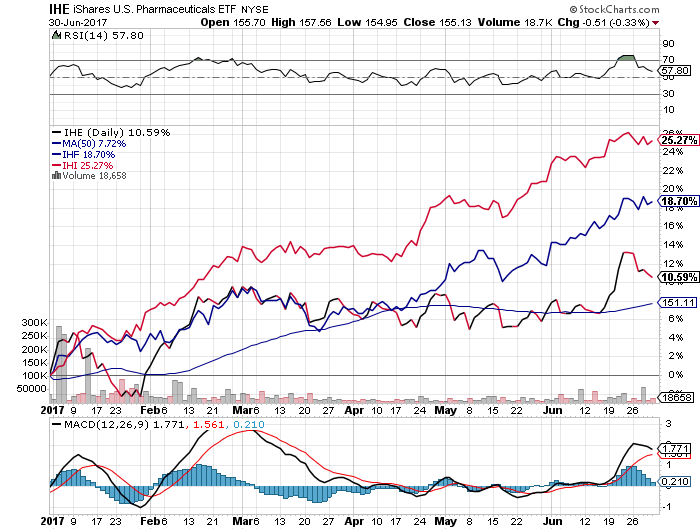

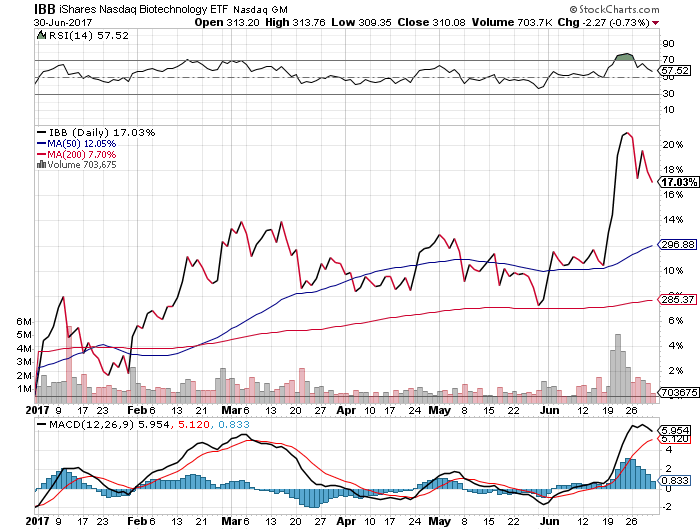

Biotech (IBB)

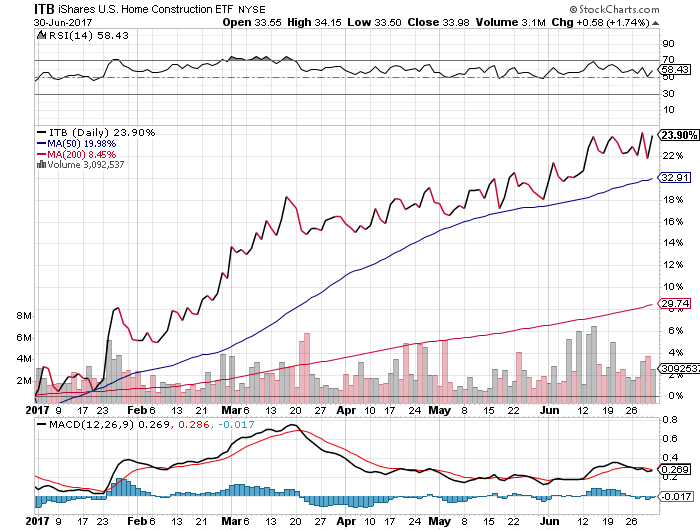

U.S. Home Construction (ITB)

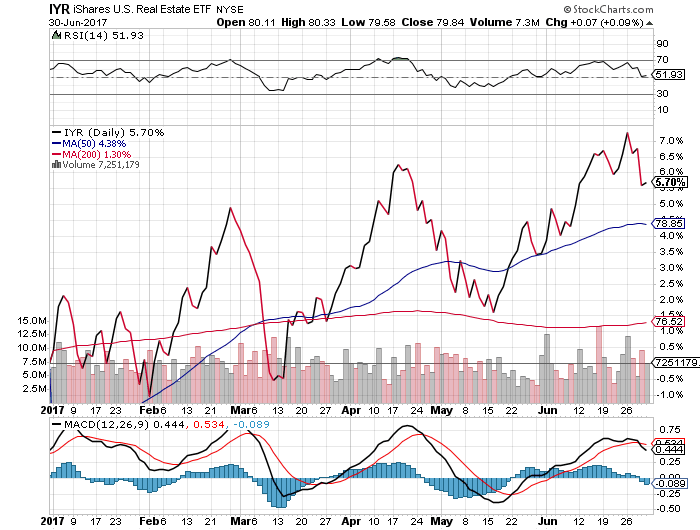

U.S. Real Estate (IYR)

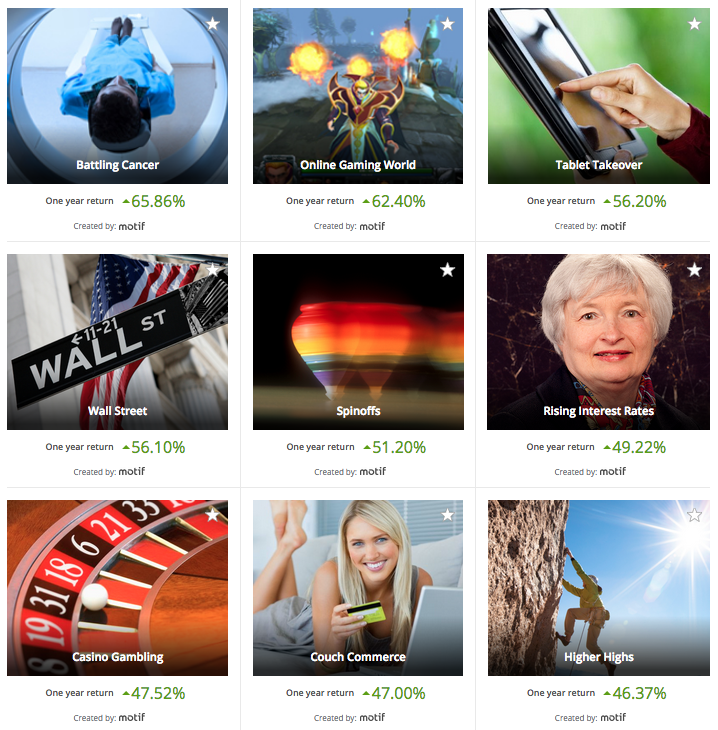

Motif Investing: Highest Earners

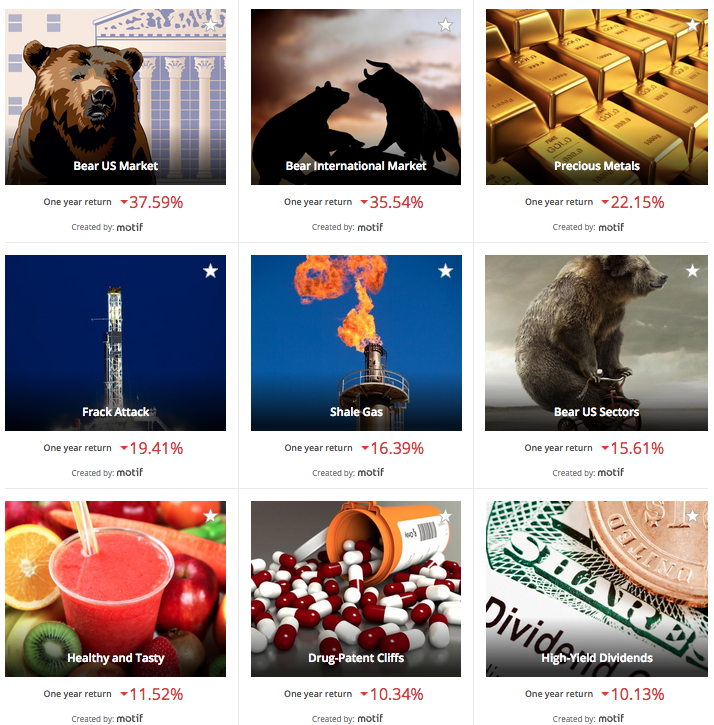

Motif Investing: Lowest Earners

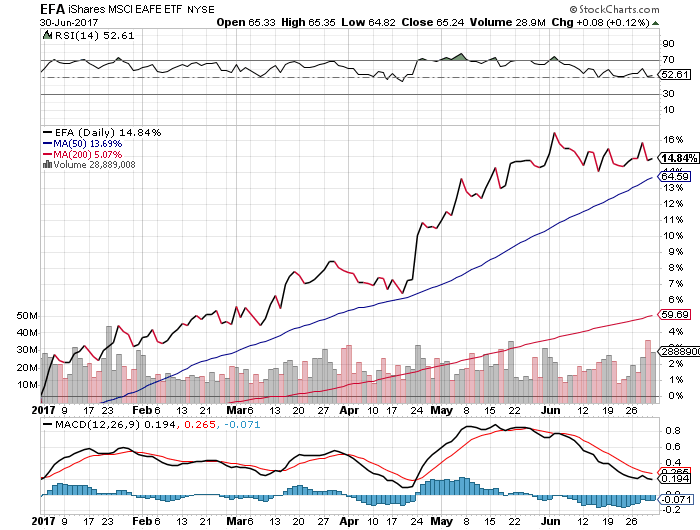

International Developed (EFA)

Europe

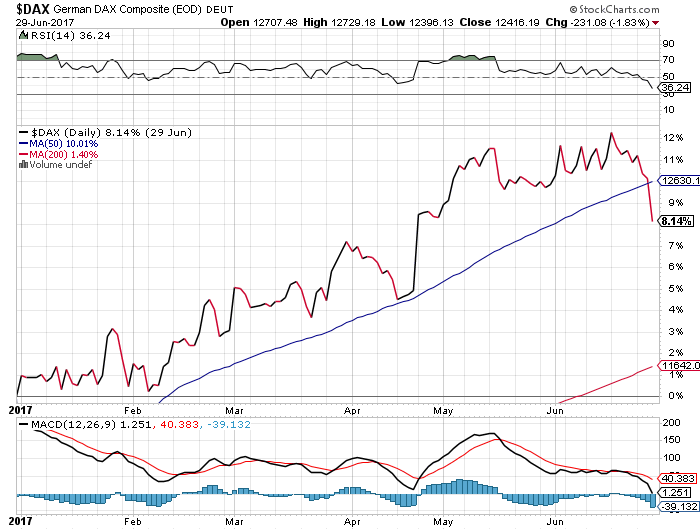

Germany (DAX)

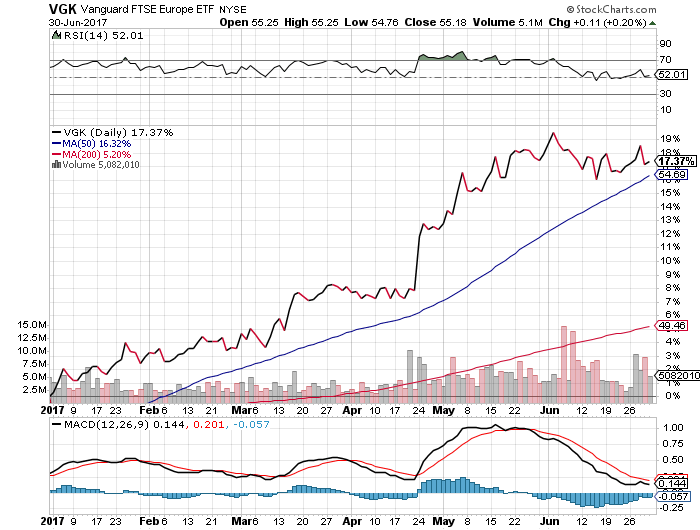

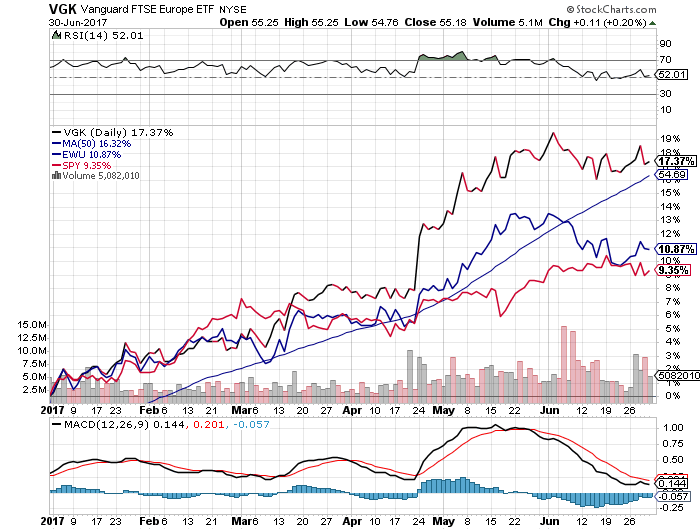

FTSE (VGK)

VGK (FTSE), EWU (UK), SPY (S&P)

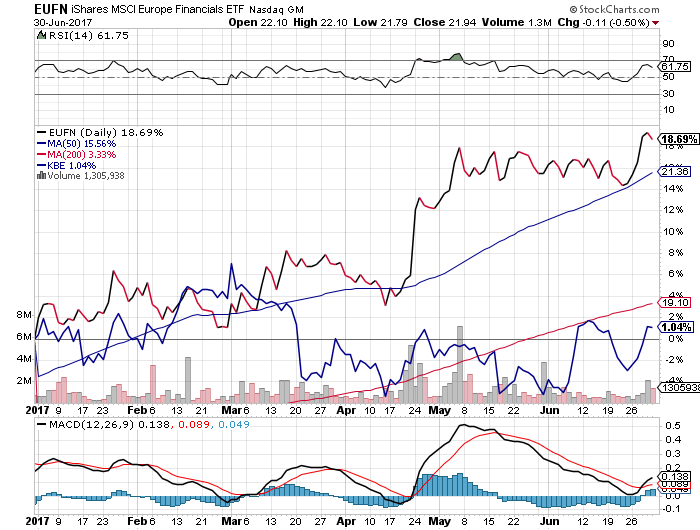

European Financials (EUFN), US Financials (KBE)

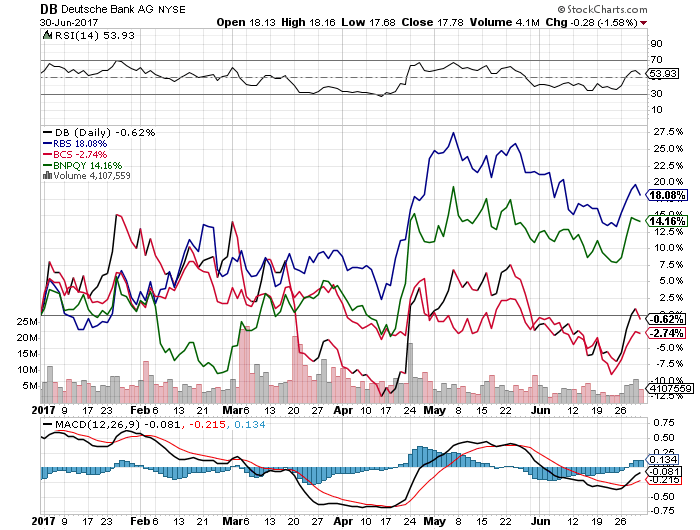

European Financials: Deutsche Bank (DB), Royal Bank of Scotland (RBS), Barclays (BCS), Paribas (BNPQY)

Asia

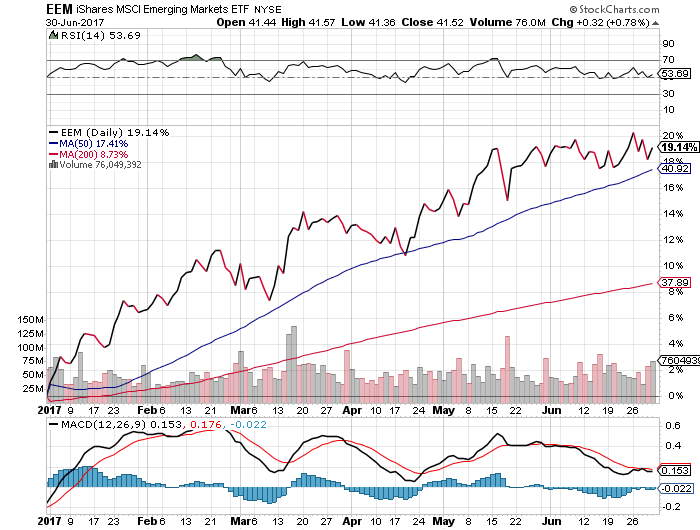

Emerging Markets (EEM)

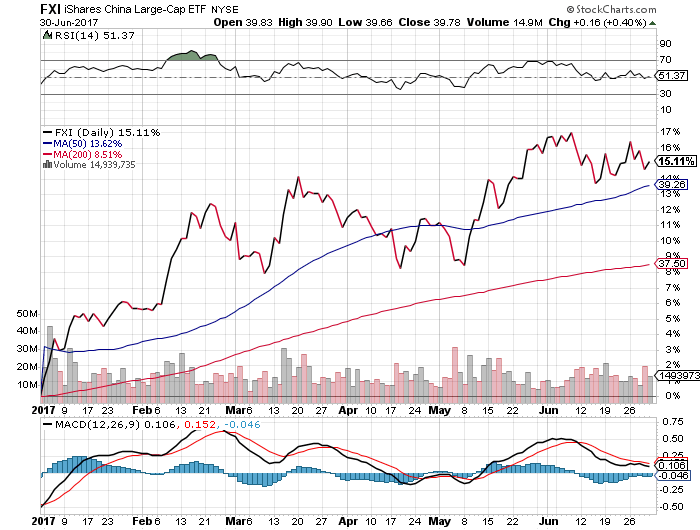

China Large Caps (FXI)

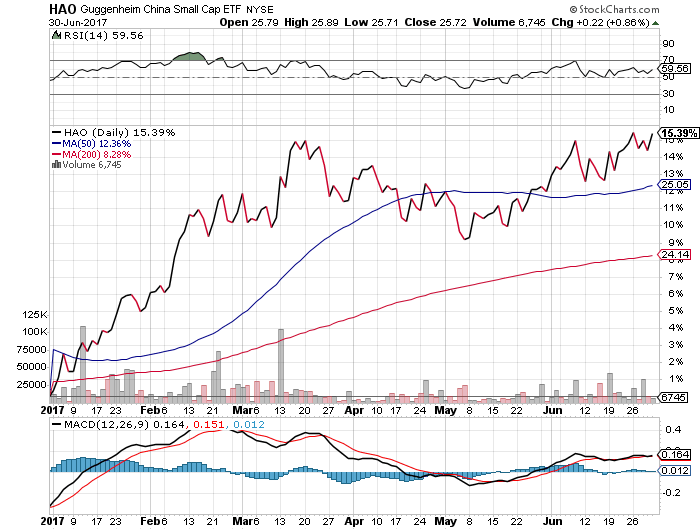

China Small Caps (HAO)

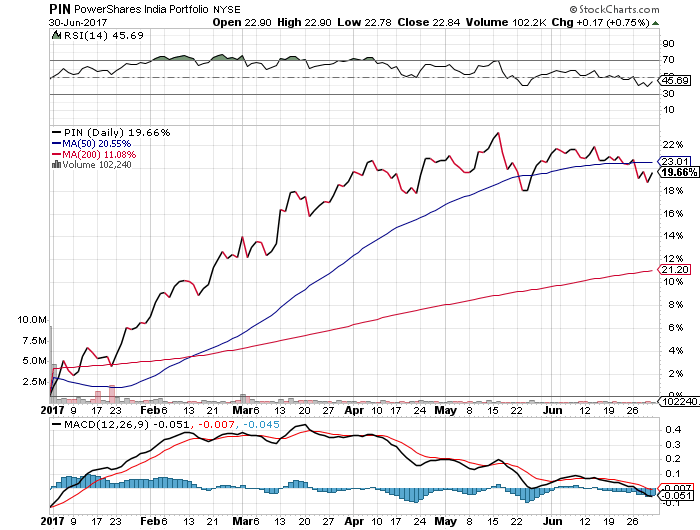

India (PIN)

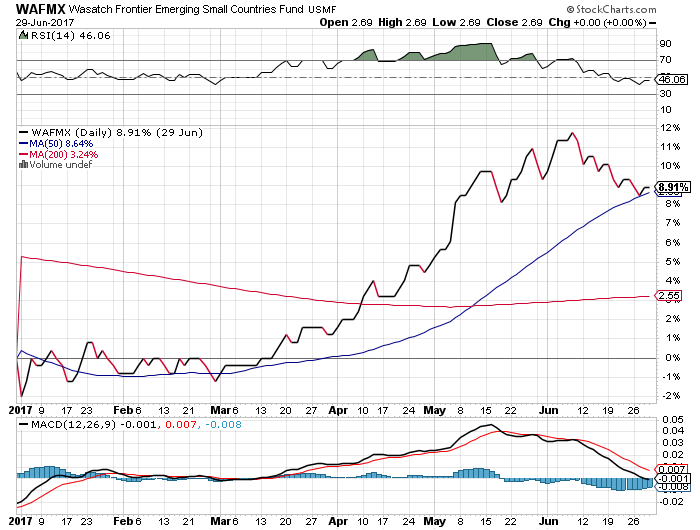

Frontier Markets (WAFMX)

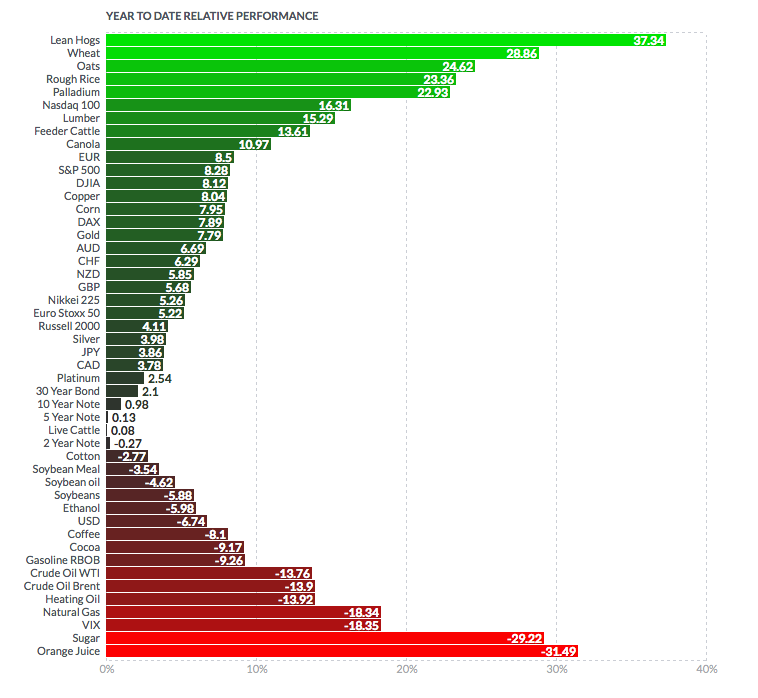

Commodities

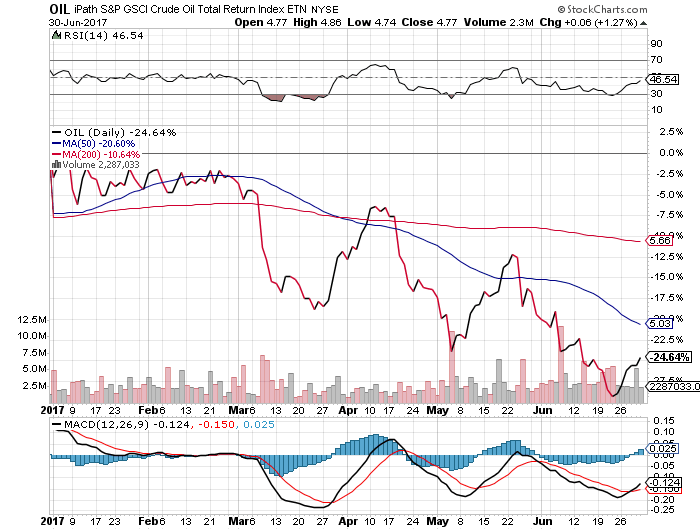

Crude Oil (OIL)

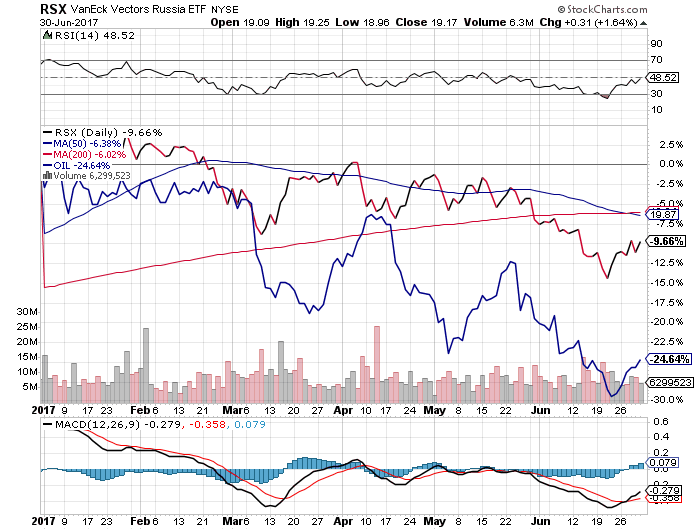

Russia (RSX), Crude Oil (OIL)

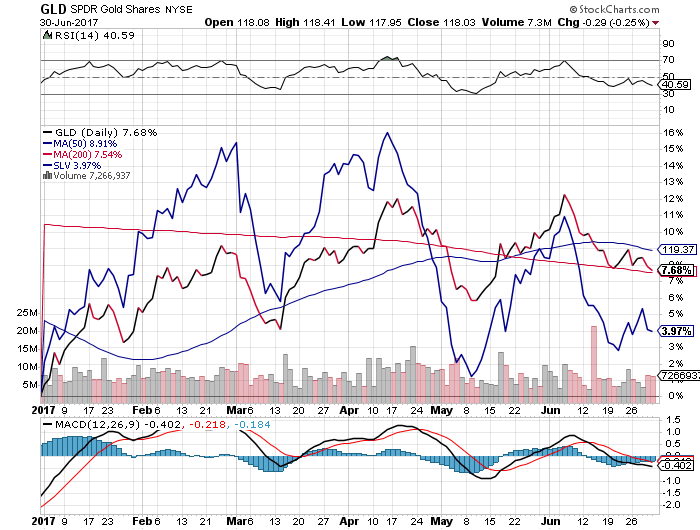

Gold (GLD), Silver (SLV)

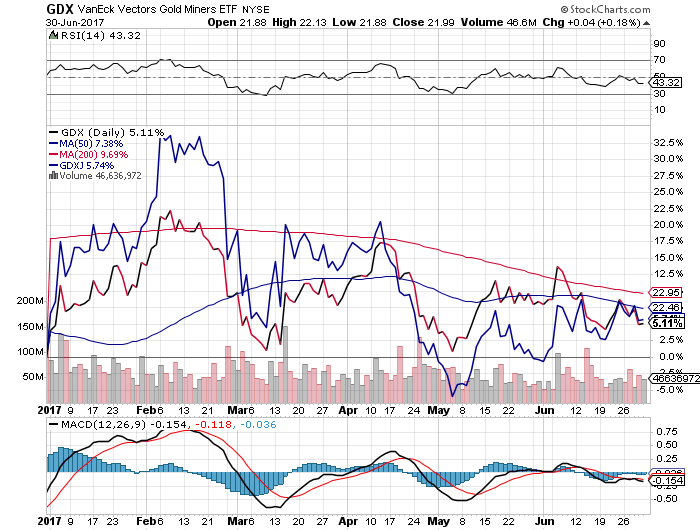

Mining (GDX), Junior Mining (GDXJ)

Commodities Index (CRB)

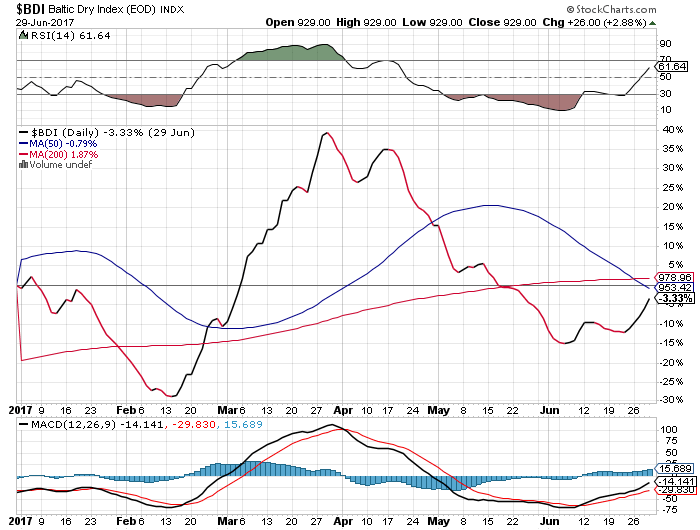

Baltic Dry Index

???